- A

-

A.dapt

- Robust and easy-to-understand bi-directional adapter for exporting data from and writing data into the Avaloq banking system

- Simple configuration, code generation and a dedicated test framework for reduced implementation and testing efforts.

- Controlling: Stay informed with Dashboards, advanced logging and self-monitoring capabilities

- Price

- On request

- Technology

- Oracle, Avaloq, JDBC, JSON, XML, ti&m digital platform

- Hosting

- in Switzerland

- Company

- Asubium More about the provider

- C

-

Cash

Your ATM Infrastructure: Standardized, Secure and Reliable.

Around 6,000 ATMs in Switzerland and Liechtenstein settle their transactions via the SIX network. Cash withdrawals and deposits are secure and can be made around the clock. SIX has a continuously monitored connection to card schemes including American Express, China Union Pay, Diners Club, JCB, Mastercard and Visa.

SIX has also worked with banks to standardize the ATM landscape, allowing participating banks to benefit from reduced procurement prices from equipment manufacturers, maintenance savings and standardized customer and advisor functions. SIX defines and manages common standards and requirements for each network, as well as processing interbank and internal bank transactions.

- Price

- On request

- Hosting

- no data

- Company

- SIX BBS AG (SIX Banking Services) More about the provider

-

Connectivity

bLink - The pioneering connection to Open Finance in Switzerland

With bLink, the Open Finance platform from SIX, financial institutions and third-party providers exchange data securely and efficiently using standardized interfaces (API, Application Programming Interface). Thanks to the high degree of standardization, bLink allows a simple one-time connection as well as maximum scalability on the market. bLink offers the opportunity to build digital ecosystems and creates a win-win situation for all participants. This strengthens competitiveness in the Swiss financial center and opens up numerous opportunities for new services and customer relationships.

- Price

- On request

- Hosting

- no data

- Company

- SIX BBS AG (SIX Banking Services) More about the provider

- D

-

Debit & Mobile Services

Effective Debit Card Issuing Solutions.

SIX helps meet your customers’ specific needs with extremely flexible processing and card administration solutions. We support the entire spectrum of relevant international debit card brands as well as proprietary bank cards.

We are also always introducing new and innovative add-on services. SIX can help you outsource your debit card programme support processes. We have vital expertise in fraud prevention and detection as well as chargeback processes. You can also reach us 24/7 with the SIX Blocking Center and new customer services for 3D Secure support.

- Price

- On request

- Hosting

- no data

- Company

- SIX BBS AG (SIX Banking Services) More about the provider

-

Digital Banking

Nowadays, digitalization of services is more important than ever, and nowhere is it more important than banking. However, many banking institutions may need help transitioning from physical to e-banking and mobile banking solutions. This is where G+D Netcetera comes in.

With over 25 years of experience in providing digitalized banking solutions, we understand your challenges and know exactly how to support you, whether you need to start from scratch, update your existing solution or create something entirely new - we want to create the perfect user journey for your customers.

Our online banking solutions enable your customers to conveniently access banking services anytime, anywhere on easy to use interfaces. Keep your customers closer than ever.

- Price

- On request

- Hosting

- no data

- Company

- G+D Netcetera More about the provider

-

Digital Banking Suite

The Digital Banking Suite takes your #eBanking to a new level. Offer your #banking customers an unprecedented #customerexperience with innovative features.

✔️ Multi-channel app: PC and mobile app from a single source.

✔️ The + for investors: portfolio simulator with historical and #real-time data.

✔️ User experience like in social media with timeline

✔️ Chats & Bots: with digital assistants for top customer service 24/7

✔️ Digital marketing functionalities, seamless in-app purchases

✔️ DataHub: comprehensive API catalog for integration into banking IT.

- Price

- On request

- Hosting

- no data

- Company

- mimacom ag More about the provider

- E

-

ELA Credit

We have been successfully building digital loan advisory solutions for our customers since 2008 and can draw on more than 120 person-years of experience in the development of loan advisory solutions. With our ELA solution model, we offer individualized, sustainable end-to-end solutions based on state-of-the-art end-user technologies and market-proven back-end IT infrastructures. We are familiar with all omnichannel customer journeys in credit counselling. Financing for private or corporate customers, we digitally implement any type of advisory process, whether new loan, redemption, mutation or extension. Our service model covers the entire software life cycle.

- Price

- On request

- Technology

- Java, Angular, React

- Hosting

- in Switzerland

- Company

- finnofleet schweiz More about the provider

- F

-

Finance Industry Solutions

calculo - intelligent fee management

Automate fee processing with a single platform. calculo manages, calculates, controls and processes all types of incoming and outgoing fees for you. User-friendly, audit-proof and efficient.

Benefits at a glance:

- Transparency and traceability of all invoices

- Unburden your employees

- Reduce errors and costs

- Meet audit, compliance and risk management requirements

- Easily comply with legal and regulatory requirements

Possible applications:

- Product fees

- Partner fees

- Calculation Methods

What you can expect from calculo:

- Fee calculation

- Fee automation

- Reporting & Analysis

- Traceability & Security

- Compatibility

- Flexibility

- Intuitive system based on the latest technologies

- Price

- On request

- Technology

- Finance Industry Solutions

- Hosting

- in Switzerland

- Company

- CONVOTIS More about the provider

- I

-

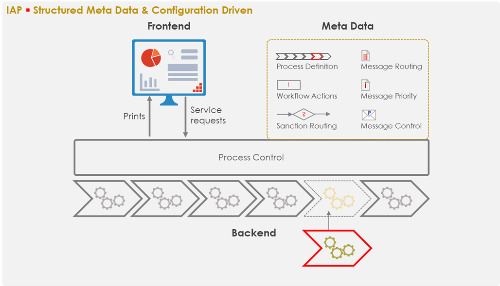

IAP Innovation Acceleration Platform

There is a consensus that innovation is positive and essential for survival in the rapidly changing and highly competitive financial industry.

However, budget and capacity constraints lead to insufficient innovation.

Although these two factors are always limited, innovation can be strengthened by increasing efficiency and decoupling innovation from scarce resources.

Instead of focusing on one selected innovation, it makes more sense to implement several innovations with the same resource capacity and test their market success.

By using IAP, your teams can innovate faster and more efficiently, putting you one step ahead of the competition!

- Price

- volume based

- Version

- 7

- Technology

- Low-Code / No-Code innovation platform

- Hosting

- no data

- Company

- Incentage AG More about the provider

-

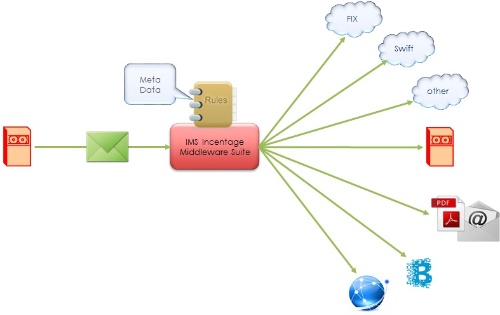

IMS - Incentage Middleware Suite

IMS, the Incentage Middleware Suite, is the messaging integration solution which increases quality and reduces the risk and time needed to complete integration projects.

IMS is a fully modular rules engine designed for message transformation without the need to write code. Applications can be interconnected using the comprehensive set of adaptors, parsers and builders.

Parsers and builders use data dictionaries to fully support standards such as Swift, FIX etc.

- Price

- modular price model

- Version

- 14

- Technology

- Rule based message transformation

- Hosting

- no data

- Company

- Incentage AG More about the provider

-

Intelligent Document Processing (IDP) for banking

Banks automate and streamline their document processing with the most advanced, cloud-native Intelligent Document Processing (IDP) platform.

Our solution is designed to meet stringent InfoSec and Compliance requirements, ensuring data security while leveraging cutting-edge AI technology. From mortgage and credit applications to digital mailroom and automated form processing, the Parashift IDP Platform covers all your document automation needs.

The platform offers comprehensive features including document Separation, Classification, Extraction, and Validation, ensuring seamless processing from start to finish. With robust cloud security, granular access controls, and compliance with ISO 27001 and EU-DSGVO standards, the platform offers banks a secure and efficient way to handle all documents.

- Price

- On request

- Technology

- Intelligent Document Processing (IDP) powered by AI

- Hosting

- in Switzerland

- Company

- Parashift AG More about the provider

-

ISE Pay

Mit ISE Pay erhalten Sie eine ausgereifte und kostengünstige Lohnbuchhaltungs-Software, welche seit Jahren erfolgreich im Einsatz ist. Mehrmandantenfähigkeit, DTA-Modul für vereinfachten Zahlungsverkehr, Funktion für Quellensteuer, Generierung von individuellen Berichten und Abschlüssen und die laufende Swissdec-Zertifizierung: dies sind einige Highlights der neuen Software.

- Price

- 1069.20 CHF inkl MwSt.

- Version

- 2.0

- Technology

- Die neue ISE Pay-Software basiert auf den modernsten Microsoft-Technologien wie Silverlight und .NET-Framework. ISE Pay kann als Einzelplatzlösung oder Mehrbenutzer-Software betrieben werden und funktioniert sowohl mit Windows als auch mit Mac OS X. Die Lösung kann sowohl als Cloud- wie als OnPremise-Version lizenziert werden.

- Hosting

- no data

- Company

- ISE AG Informatik Solutions Einsiedeln More about the provider

- P

-

PM1

PM1 is a leading Portfolio & Wealth Management software for retail and private banks, independent wealth managers, family offices, and asset managers. It offers a wide range of versatile modules to manage customer relationships and plan, execute, and analyze investments within an easy to use, browser-based interface.

- Price

- by request

- Hosting

- no data

- Company

- Expersoft Systems AG More about the provider

- T

-

ti&m Banking

The modular setup of our ti&m Banking software allows you to adapt your services flexibly and efficiently to the needs of your customers. Create an enhanced user experience at every touchpoint. We combine our expertise and highly scalable technology with a customer-friendly and appealing design. Discover our digital banking software products in detail.

- Price

- On request

- Hosting

- in Switzerland

- Company

- ti&m AG More about the provider

- B

-

Billing & Payments

Innovative Solutions for Payment Transactions.

The payments industry is changing. The Billing and Payments ecosystem from SIX has steadily established itself as a center of excellence for fast, reliable and secure payment solutions for the Swiss financial center. It aims to comprehensively cover the market's many different user groups and needs. It focuses on achieving maximum security, user friendliness and convenience – while requiring minimal investment from banks, invoicers and software partners. SIX generates synergies and economies of scale by bundling and standardizing payments infrastructure. In the process, we create an infrastructure for efficient, sustainable processes between financial institutions, service providers and consumers.

- Price

- On request

- Hosting

- no data

- Company

- SIX BBS AG (SIX Banking Services) More about the provider