BPO — the model for the future

Whereas some IT themes flare up briefly and die down just as fast, Business Process Outsourcing (BPO) is a sustained trend. This also applies to the financial sector, which now faces profound challenges.

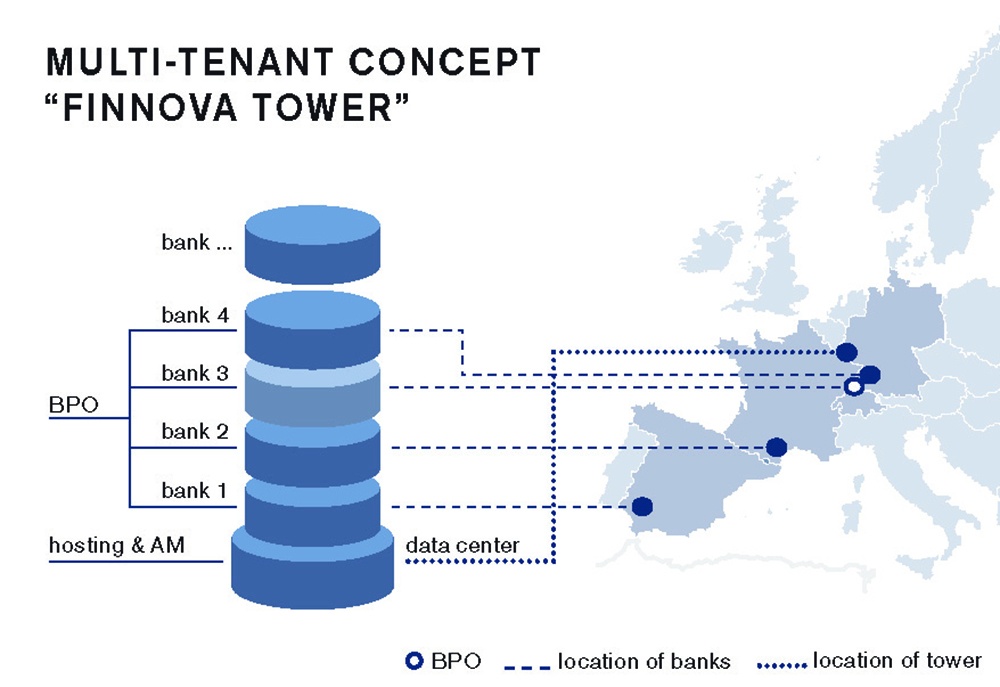

Joint data storage (1 database) allows for both flexibility and individuality.

Joint data storage (1 database) allows for both flexibility and individuality.

Whereas business process outsourcing has already been established in the automotive and other sectors for decades, the financial industry has been slow to realize the benefits of professional BPO. This may be due in part to the confidentiality requirements of the banking business. However, income, price and margin erosion in the context of the global financial crisis now requires this industry to cut costs and increase efficiency to safeguard its economic viability. One key consideration here is for banks to focus on their core business and core competencies. Outsourcing entire processes or process steps to reduce vertical integration is a logical and increasingly important consequence. Banks will only be able to meet current and future challenges by adopting this approach.

With industrial products on the one hand and services on the other, are the automotive and banking industries really comparable? Based on optimized vertical integration, standardization and industrialization, every individual car can now be cost-efficiently custom-produced with a wide range of options and accurately defined processes. This can also be applied in the financial sector. As elsewhere, the challenge here is to design the innumerable standard building blocks and their interrelationships in a way that permits flexible combinations and upgrades. This is the precondition for BPO customers to benefit sustainably from customized services.

Not only a technical question

Regardless of the industry concerned, companies that opt for BPO expect maximal autonomy, flexibility and freedom of choice as regards the processes or process steps to be outsourced. Economically efficient outsourcing requires open systems which permit both integration and link-up. Alongside these technical considerations, other aspects also need to be addressed.

One main question is how much know-how an organization wants to retain inhouse. For example, updating increasingly specialized knowledge can lead to continuously increasing costs. Particularly for complex transactions involving specific tax issues, small banks often no longer possess the knowledge and business volume required to make in-house operation economically viable. Outsourcing to experts minimizes the costs for updating specialized knowledge. At the same time, consistent pooling of such orders can be used to achieve the required volumes and better prices. In the regulatory environment, for example, new players are entering the BPO market and offering their services to banks that wish to focus exclusively on their core business.

Scales and skills

Today, advanced systems permit banks to retain only their front office organization with the customer contact functions in-house, allowing a greater focus on their core advisory competencies. If the complete back-office is to be outsourced, the provider must be able to access all processes assigned to it, and the efficiency of the processes and sofware is a key concern here.

The preconditions for the success of BPO in the financial sector are that all process steps are integrated into the minimum number of screens possible. Single signon, intelligent automation, an integral workflow and straight-through processing are key features. Pooling orders to achieve the required volumes presupposes a high level of process standardization and scalability of the IT platforms used. In addition to scale effects, the skills of the specialists involved play a key role in BPO. They go far beyond the proverbial ’swift hands’. BPO providers need to understand the business of their customers and possess profound specialized knowhow because they have to handle special cases while the system processes standard orders industrially.

Open software, open market

In addition to classic providers, banks themselves can also offer BPO and therefore gain access to additional sources of income by insourcing. For example, a bank can service the securities for several financial institutions. This preserves jobs in less dynamic regions and ensures that the knowhow is retained within the banking group. In another instance of modern BPO, a full service bank takes over the entire back-office of its private bank based on its own full-service platform and therefore maximizes both volume and quality at a lower cost. As part of a comprehensive banking solution, such concepts are no longer the exception but the rule within the user community. Today, more than 90 percent of all banks that use Finnova benefit from the application’s comprehensive BPO options. Apart from the system’s openness, a market offering with a choice of providers is also a key precondition for continuous advances in BPO. The improved quality, larger service portfolio and scope for price reductions ultimately contribute to improving the performance of the financial marketplace as a whole.

BPO is still expanding in Switzerland, and an end to this trend is not in sight. Many banks are currently defining their core competencies because processes that do not distinguish them from competitors can be centralized, pooled and processed efficiently outside. This lowers vertical integration and opens up new opportunities in a period of sinking incomes and margins. The use of a comprehensive modular bank solution is the precondition for the development of integrated BPO solutions and ultimately guarantees that banks can continue to compete successfully in a globalized market.