Beyond compliance

Aside from compliance, banks are focusing heavily on the shift towards digital banks. It is not always easy to fit both under one roof. Qumram helps banks to master this balancing act.

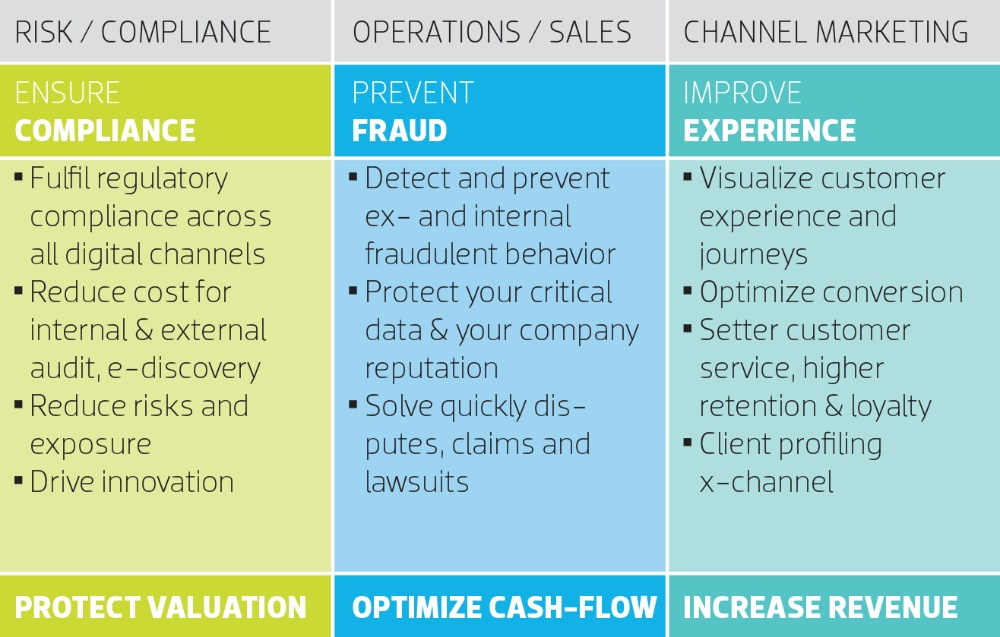

Qumran combines three key topics for financial institutions under one roof, allowing deep in - sights into the link between compliance and digitization – a digital trinity.

Qumran combines three key topics for financial institutions under one roof, allowing deep in - sights into the link between compliance and digitization – a digital trinity.

According to UBS chairman Axel Weber, there are approximately 60 new compliance regulations to consider and implement every day. The associated requirements have an impact on all of a bank’s strategies and areas of activity. On the one hand, compliance is paving the way forward. On the other, it stands in the way of the second big trend – digitization. More and more physical branches are closing, and services and consultations are increasingly shifting into the digital space.

“The pressure of compliance is very high, which is why there is only a half-hearted drive towards digitization. In order to achieve medium- to long-term success, both of these concepts must be brought under one roof,” says Qumram CEO Patrick Barnert.

This is where his company comes into play. Originally conceived as a pure compliance solution, Qumram now also covers fraud detection and user experience analysis. The software helps the bank to specifically overcome the issues that result from this combination of compliance and digitization.

New regulations

An example: New regulations like MiFID II are intended to increase consumer protection. Banks must demonstrate that the customer has been given comprehensive advice, including advice that relates to their personal situation. This is evidenced by recording the minutes of the consultation, which are sent to the customer after the meeting. The form a consultation takes is no longer set in stone – in addition to in-person meetings and the telephone, there are also various online services: credit applications, financial management tools, securities reports and recommendations, or online trading. Where does the bank’s duty to record everything end?

Opinions vary, depending on the compliance officer you ask. The only consistently approved strategy is keeping complete documentation of all customer interactions. This is what Qumram does. The software records all user sessions. Depending on the configuration, no matter whether the customer is logged in or not. Every recording can be played back after. It shows the customer’s perspective and allows the bank to prove what information was provided to the customer and when.

Behavioral analysis

Properly implemented, this satisfies compliance requirements. It simultaneously creates a rich base of information which can support the institution in its digitization. Qumram’s records show exactly where electronic processes run into difficulties and support their optimization. However, the software is not only there for external interactions – it can also be used for internal sessions. Combined with behavioral analysis, it can be used to spot atypical behavior in real time. For example, if an employee accesses customer data that is not relevant to his work, the software will flag it up.

Thus, Qumram combines clever compliance with improved user experience and fraud detection – a forward-thinking approach.